Affordable Finance

- Up to 10 year finance

- Can be less expensive than cash using the correct tax strategy

- 100% tax deductible payments

- Installation on leased properties OK

- No financials required up to $50,000

- Options includes solar rental, structured finance and lease or chattel mortgage

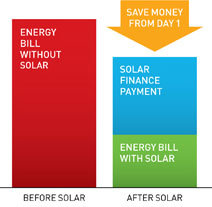

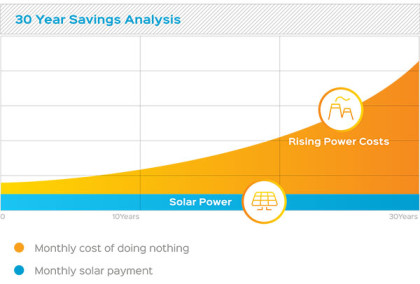

Less Expensive Than Cash

If you pay company tax, deductions are generally allowed under ITAA 97 for interest expenses and depreciation of assets.

Taking into account the savings from your power bill and tax savings from ATO rulings, you could pay less than the cash price.

Finance Options

Hire Purchase

With the large tax benefits, this is an attractive financing option for taxpaying companies. Under this arrangement, the financier purchases the goods and rents them to you.

This allows you to claim a 100 % tax deduction for installment payments and GST is refunded with your quarterly Business Activity Statement (BAS). The asset does not appear on your balance sheet, giving you more flexibility to fund your business.

Lease or Chattel Mortgage

Our financier provides you with the funds to purchase the goods and takes a charge over the asset. As the whole amount is financed, payments tend to be higher than rental.

The main advantage is the refund of the GST on the entire purchase price with your next BAS. However, only interest is deductible and the asset is depreciated over 20 years.

Structured Finance

As you are using the asset to reduce your operating costs, we can offer structure payments to match savings for larger transactions. Our objective is to craft a solution which supports the business goals of your company.

Qualification

- Must have an active ABN and use the energy produced primarily for business purpose

- For transactions over $50,000 a financial assessment may be required

- A driver’s licence or passport for each signature

- Only a driver’s licence is required for transactions under $50,000 for property owners

Disclaimer

Applications are subject to credit approval and terms and conditions of finance company. This information is presented to assist making an informed decision about financial products to support your decision to make a purchase. This is not an offer of finance, does not present financial, accounting, general or personal advice nor is it a recommendation.